AvaTax use¶

AvaTax is a tax calculation software that can be integrated with Odoo in the United States and Canada. Once the integration setup is complete, the calculated tax is simple and automatic.

Tax calculation¶

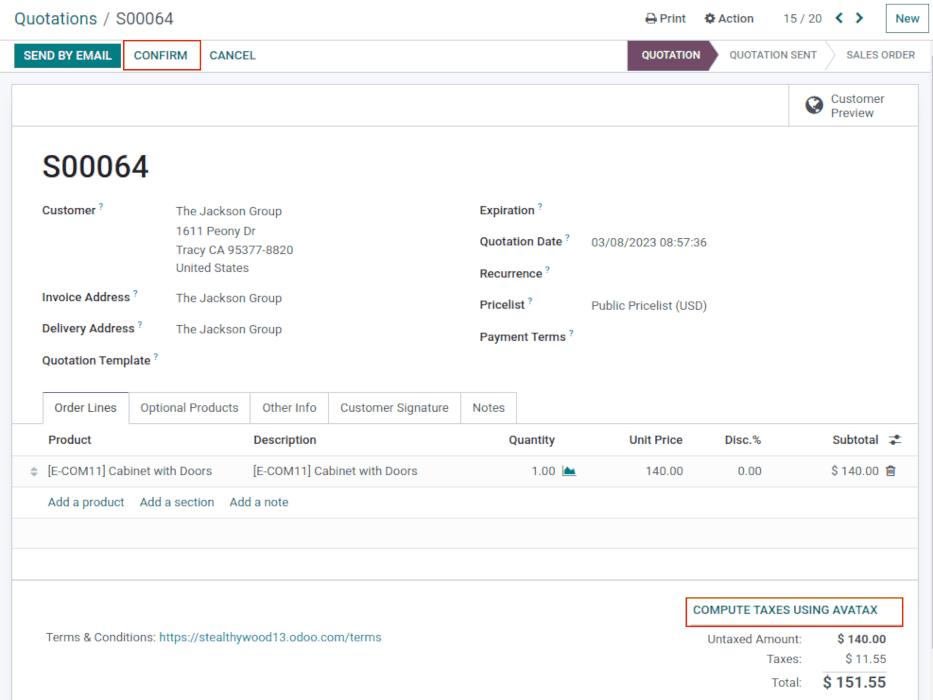

Automatically calculate taxes on Odoo quotations and invoices with AvaTax by confirming the documents during the sales flow. Alternatively, calculate the taxes manually by clicking the Compute taxes using Avatax button while these documents are in draft mode.

Tip

Clicking the Compute taxes using Avatax button recalculates taxes if any product lines are edited on the invoice.

The tax calculation is triggered during the following automatic trigger and manual trigger circumstances.

Automatic triggers¶

When the sales rep sends the quote by email with Send by email button (pop-up).

When the customer views the online quote on the portal.

When a quote is confirmed and becomes a sales order.

When the customer views the invoice on the portal.

When a draft invoice is validated.

When the customer views the subscription in the portal.

When a subscription generates an invoice.

When the customer gets to the last screen of the eCommerce checkout.

Manual triggers¶

Compute taxes using Avatax button at the bottom of the quote.

Compute taxes using Avatax button at the top of the invoice.

Tip

Use the Avalara Partner Code field that is available on customer records, quotations, and invoices to cross-reference data in Odoo and AvaTax. This field is located under the tab of the sales order or quotation in the Sales section.

On the customer record, navigate to Contacts app and select a contact. Then open the Sales & Purchase tab and the Avalara Partner Code under the Sales section.

Important

The Automatic Tax Mapping (AvaTax) fiscal position is also applied on those Odoo documents, like subscriptions.

AvaTax synchronization¶

Synchronization occurs with AvaTax, when the invoice is created in Odoo. This means the sales tax is recorded with Avalara (AvaTax software developer).

To do so, navigate to . Select a quotation from the list.

After confirming a quotation and validating the delivery, click Create Invoice. Indicate whether it is a Regular invoice, Down payment (percentage), or Down payment (fixed amount).

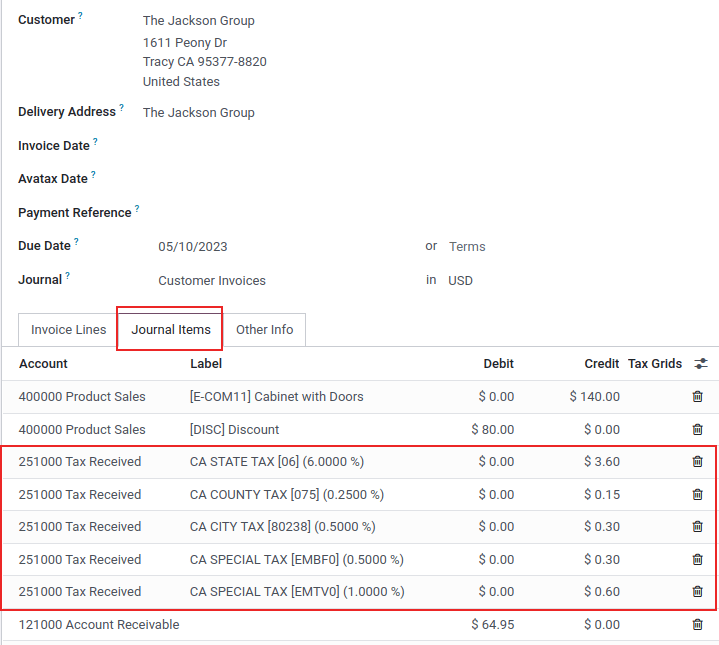

Then click Create and view invoice. The recorded taxes can be seen in the Journal Items tab of the invoice. There will be different taxes depending on the location of the Delivery Address.

Finally, press the Confirm button to complete the invoice and synchronize with the AvaTax portal.

Warning

An invoice cannot be Reset to draft because this causes de-synchronization with the

AvaTax Portal. Instead, click Add credit note and state: Sync with AvaTax Portal.

See this documentation: Credit notes and refunds.

Fixed price discounts¶

Add a fixed price discount to a valuable customer by click Add a line on the customer’s invoice. Add the product discount and set the Price to either a positive or negative value. To recalculate the taxes, click Compute taxes using Avatax.

Tip

Tax calculation can even be done on negative subtotals and credit notes.