FR0600¶

Introduction¶

The VAT declaration FR0600 must be submitted by persons registered as VAT payers in the Republic of Lithuania.

Installation and Configuration¶

The FR0600 declaration requires the installation of the FR0600 VAT Declaration module (technical name l10n_lt_fr0600).

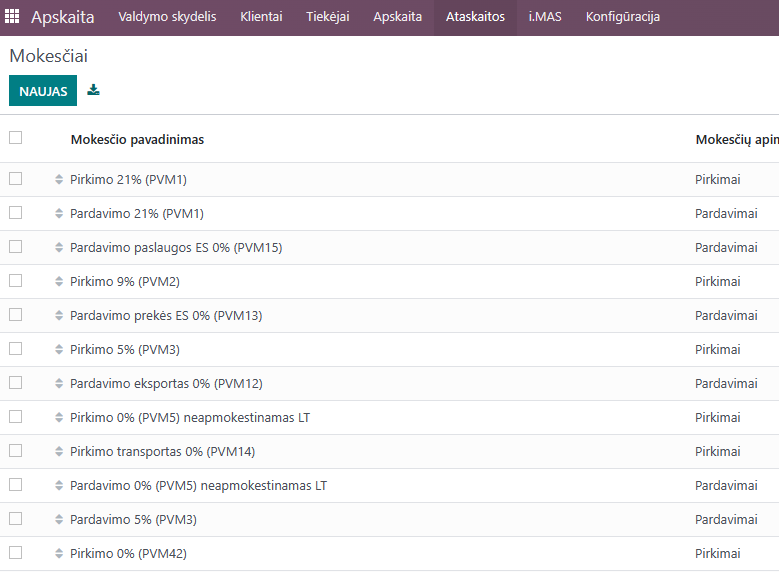

Before starting work with the Odoo system, when VAT invoices will start to be registered, it is necessary to configure the taxes:

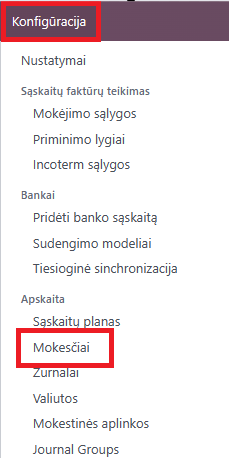

Module Accounting -> Configuration -> Taxes

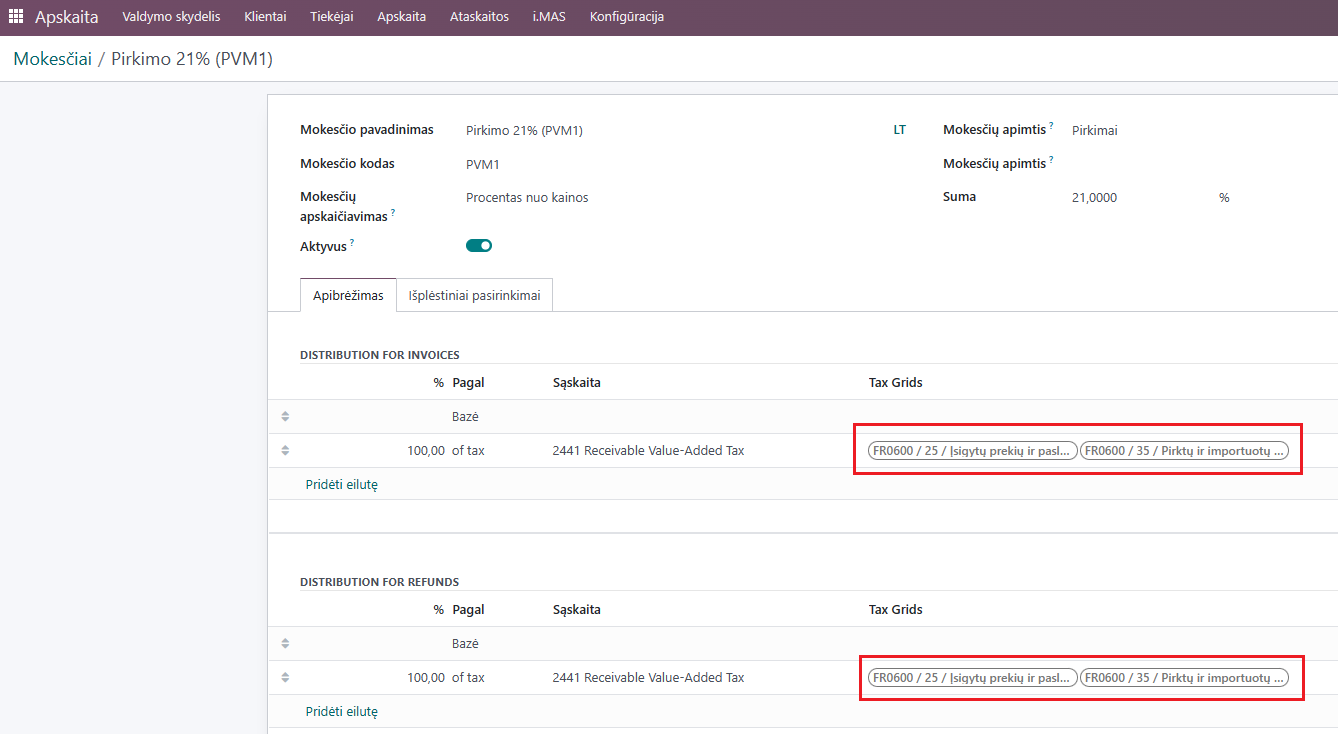

When opening the settings of the selected tax, check (or fill in) the Tax Grids fields, according to which the FR0600 declaration will be formed:

After verifying or entering the information, you can start registering VAT invoices, and after registering them, form the FR0600 declaration.

Daily Use Scenarios¶

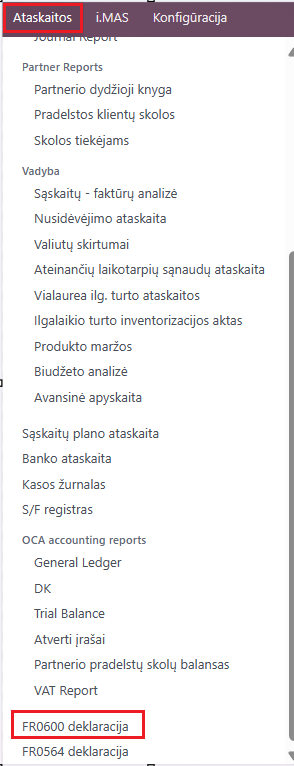

Once you have all purchase and sales VAT invoices registered for the period for which you want to form and submit the VAT declaration FR0600, select Accounting >> Reports >> FR600 declaration.

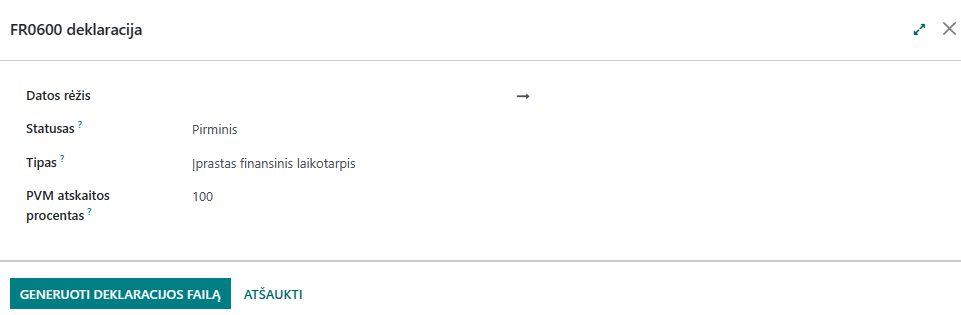

In the opened window, select:

Date range - for which period you want to form the declaration;

Status - you can form the declaration as Initial or Corrected;

Type - usually “Regular financial period”;

VAT report percentage - 100;

Click Generate declaration file

After generating the declaration file, it can be submitted directly to VMI.