iSAF¶

Introduction¶

Since 2019-07-01, all legal entities that are VAT payers must submit the data of issued and received VAT invoice registers to VMI monthly by the 20th day of the following month. The register is called the iSAF declaration. The rules for filling in and submitting VAT invoice registers are approved by the VMI Order No. VA-55 dated 2004-04-21 “On the management of VAT invoice registers”.

The main function of the iSAF report is to cross-check registered invoice data (issued and received) (customers/suppliers) in the VMI information system.

Installation and Configuration¶

Install the module (technical name) - l10n_lt_isaf

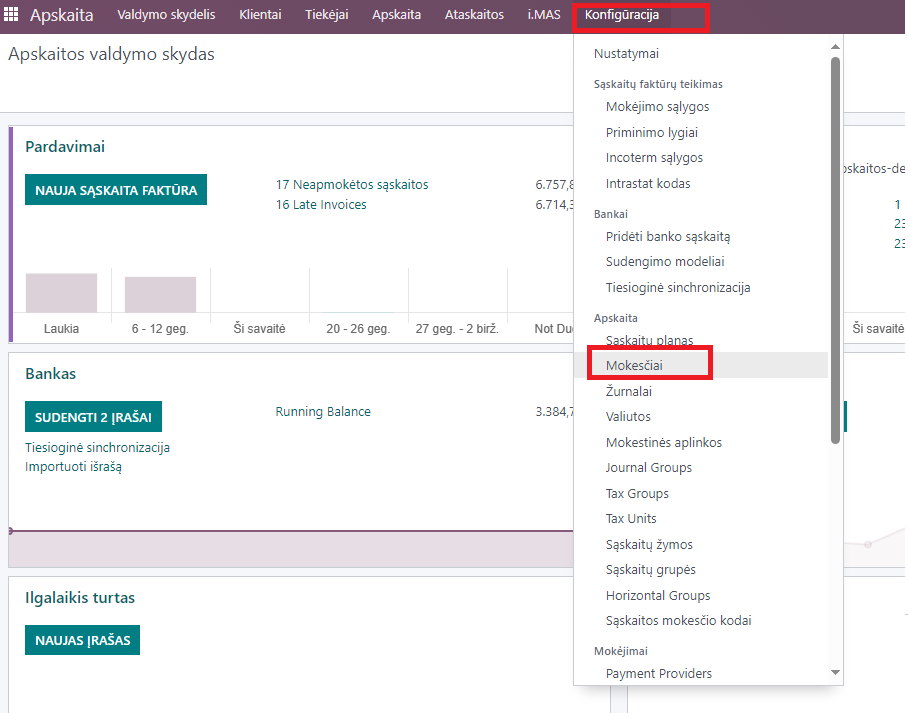

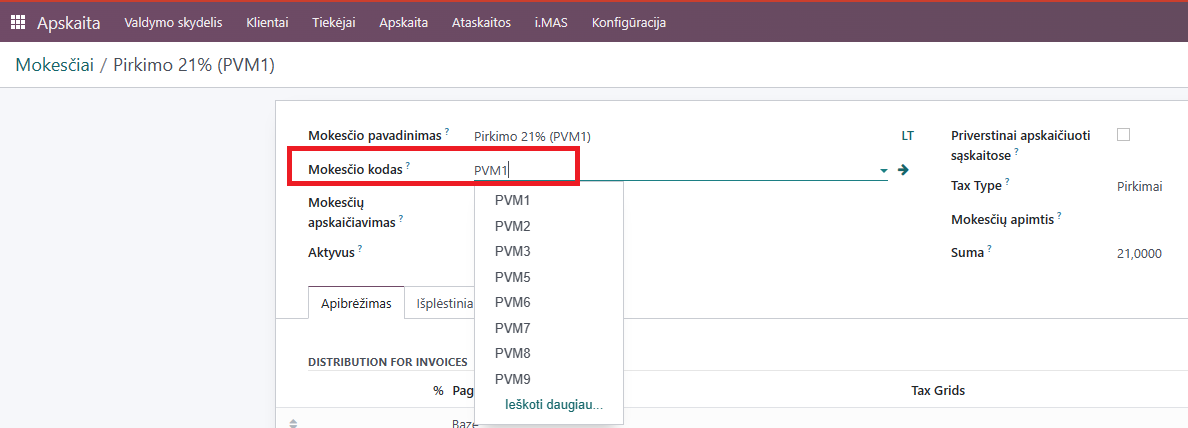

For configuration, you need to set the VAT classifier codes approved by the State Tax Inspectorate (VMI): Select the main menu - Accounting -> Configuration -> Taxes

In the tax environment, the Tax code is mandatory

Reports and Documentation¶

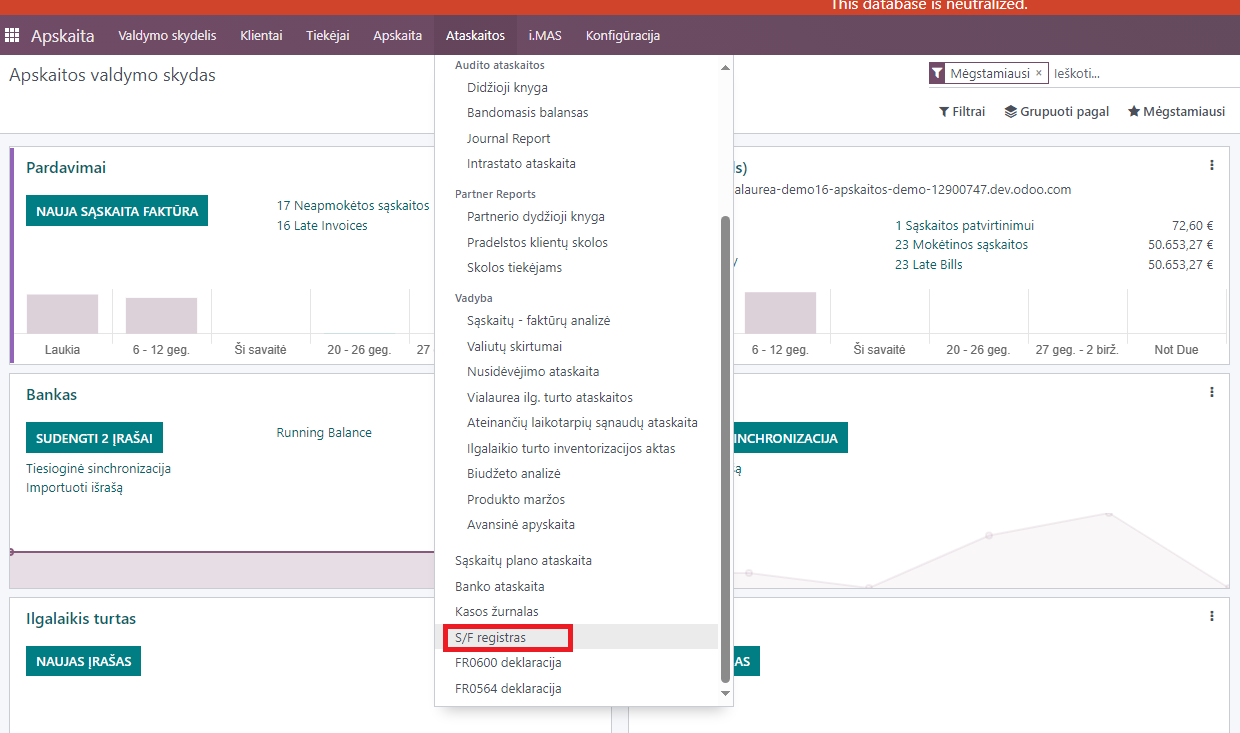

Before generating iSAF, data verification is recommended. Main menu - Reports -> Invoice registers

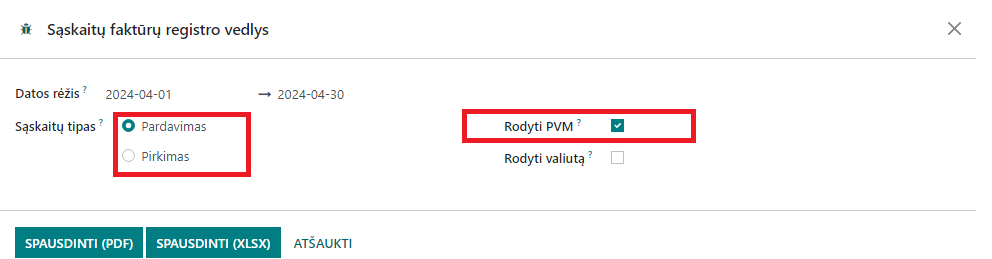

In the window that opens, we select the date (month) of the reporting period, Purchases/Sales reports are generated separately, and it is also possible to exclude VAT information by checking Show VAT.

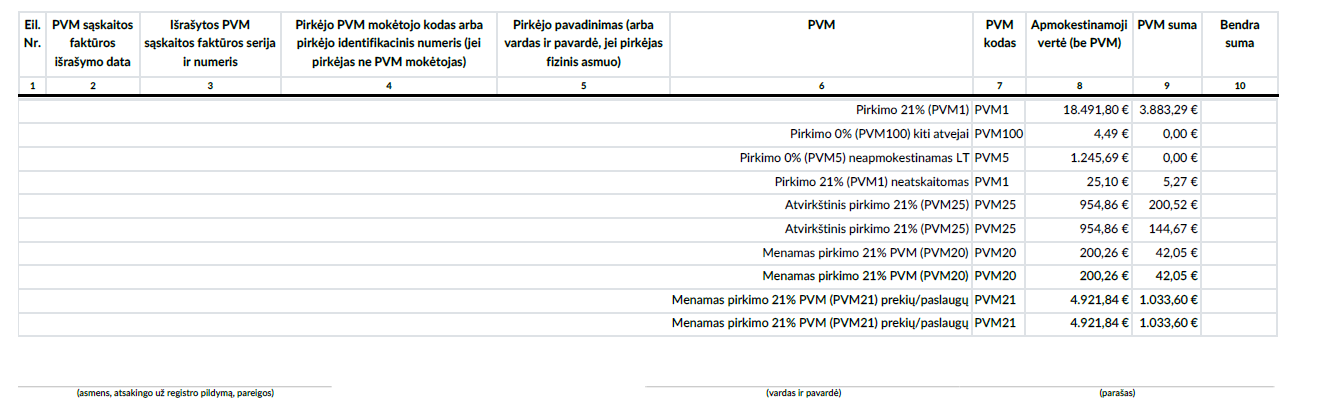

The generated report displays ALL data, including undeclared data.

iSAF Generation¶

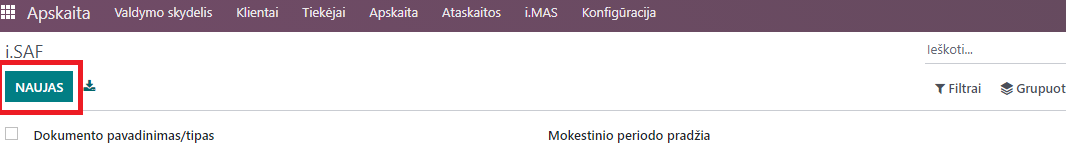

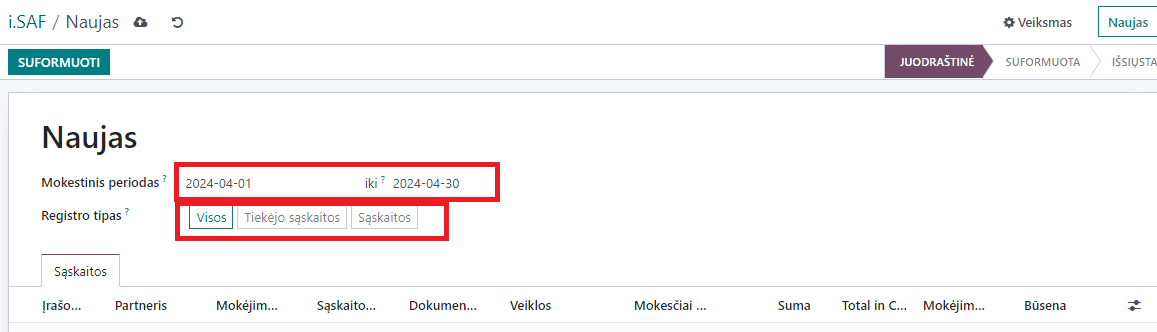

Accounting -> i.MAS -> i.SAF. Click New and create a new report.

The reporting period (month), the type of register (registered invoices) can be selected, by report (all, supplier or invoices)

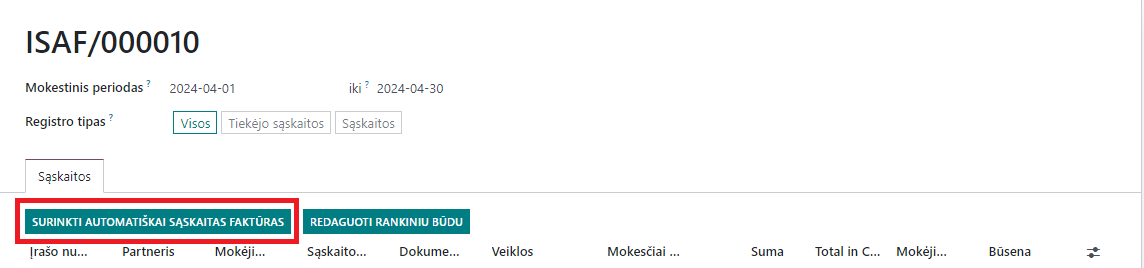

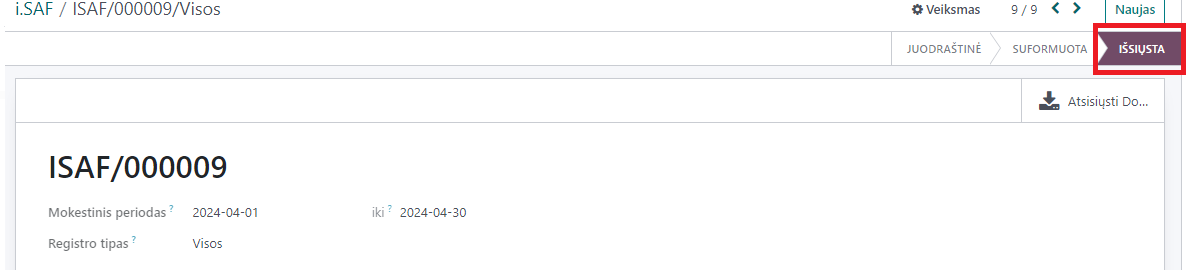

For example: Register type - All -> (save button) -> Automatically collect invoices

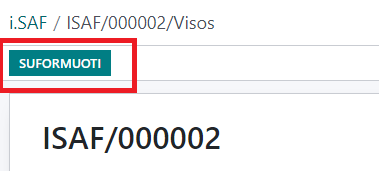

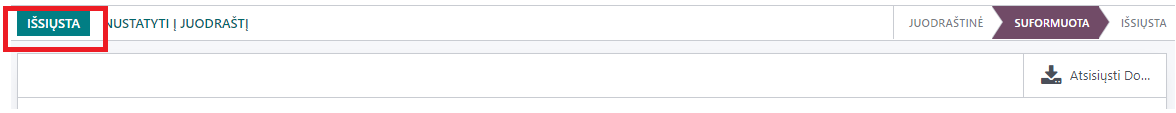

Automatically generated invoice register to be formed into an XML file

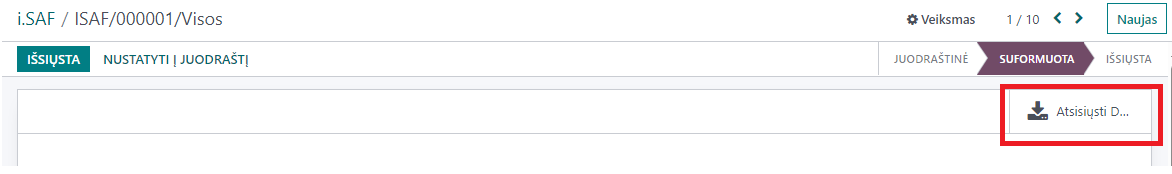

Download the generated report

and send