Spain¶

Configuration¶

Install the 🇪🇸 Spanish fiscal localization package to get all the default accounting features of the Spanish localization.

Three Spanish localizations exist, each with its own pre-configured PGCE charts of accounts:

Spain - SMEs (2008);

Spain - Complete (2008);

Spain - Non-profit entities (2008).

To select the one to use, go to and select a package in the Fiscal Localization section.

Warning

You can only change the accounting package as long as you have not created any accounting entry.

Chart of accounts¶

You can reach the Chart of Accounts by going to .

Tip

When you create a new Odoo Online database, Spain - SMEs (2008) is installed by default.

Taxes¶

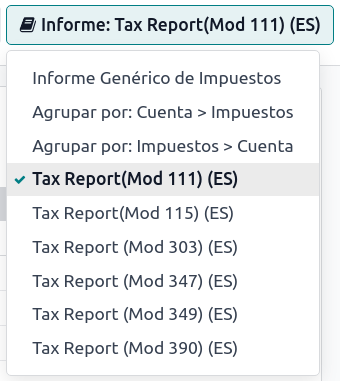

Default Spain-specific taxes are created automatically when the Spanish - Accounting (PGCE 2008) (l10n_es) module is installed, and tax reports are available when installing the module Spain - Accounting (PGCE 2008) (l10n_es_reports). Each tax impacts the Spain-specific tax reports (Modelo), available by going to .

Reports¶

Here is the list of Spanish-specific statement reports available:

Balance Sheet;

Profit & Loss;

EC Sales List;

Tax Report (Modelo 111);

Tax Report (Modelo 115);

Tax Report (Modelo 303);

Tax Report (Modelo 347);

Tax Report (Modelo 349);

Tax Report (Modelo 390).

You can access Spain-specific tax reports by clicking on the book icon when on a report and selecting its Spain-specific version: (ES).

TicketBAI¶

Ticket BAI or TBAI is an e-Invoicing system used by the Basque government and its three provincial councils (Álava, Biscay, and Gipuzkoa).

Odoo supports the TicketBAI (TBAI) electronic invoicing format for all three regions of the Basque Country. To enable TicketBAI, set your company’s Country and Tax ID under in the Companies section.

Then, install the module Spain -TicketBAI (l10n_es_edi_TBAI), go to , and select a region in the Spain Localization section’s Tax Agency for TBAI field.

Once a region is selected, click Manage certificates (SII/TicketBAI), then click New, upload the certificate, and enter the password provided by the tax agency.

Warning

If you are testing certificates, enable Test Mode in the Spain Localization section, which can be found under Accounting in the Settings app.

Use case¶

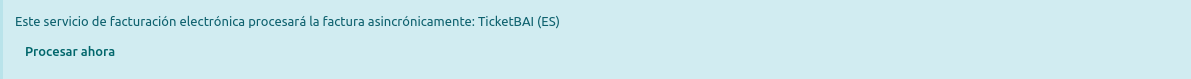

Once an invoice has been created and confirmed, a TicketBAI banner appears at the top.

Odoo sends invoices through TicketBAI automatically every 24 hours. However, you can click Process now to send the invoice immediately.

When the invoice is sent, the status of the field Electronic Invoice changes to Sent, and the XML file can be found in the chatter. Under the EDI Documents tab, you can see the traceability of other generated documents related to the invoice (e.g., if the invoice should also be sent through the SII, it will appear here).

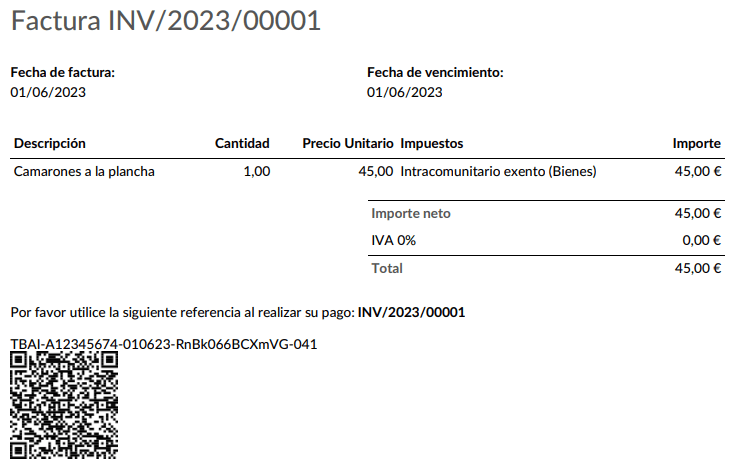

Note

The TBAI QR code is displayed on the invoice PDF.

FACe¶

FACe is the e-Invoicing platform used by the public administrations in Spain to send electronic invoices.

Before configuring the FACe system, install the Spain - Facturae EDI (l10n_es_edi_facturae) module and other Facturae EDI-related modules.

To enable FACe, go to , click Update Info in the Companies section, then click Update Info and set the Country and Tax ID of your company. Next, add the Facturae signature certificate by clicking Add a line, uploading the certificate provided by the tax agency, and entering the provided password.

Use case¶

Once you have created an invoice and confirmed it, click Send & Print. Make sure Generate Facturae edi file is enabled, and click Send & Print again. Once the invoice is sent, the generated XML file is available in the chatter.

Warning

The file is NOT automatically sent. You have to send it yourself manually.

Tip

You can send FACe XML files in batch through the governmental portal.

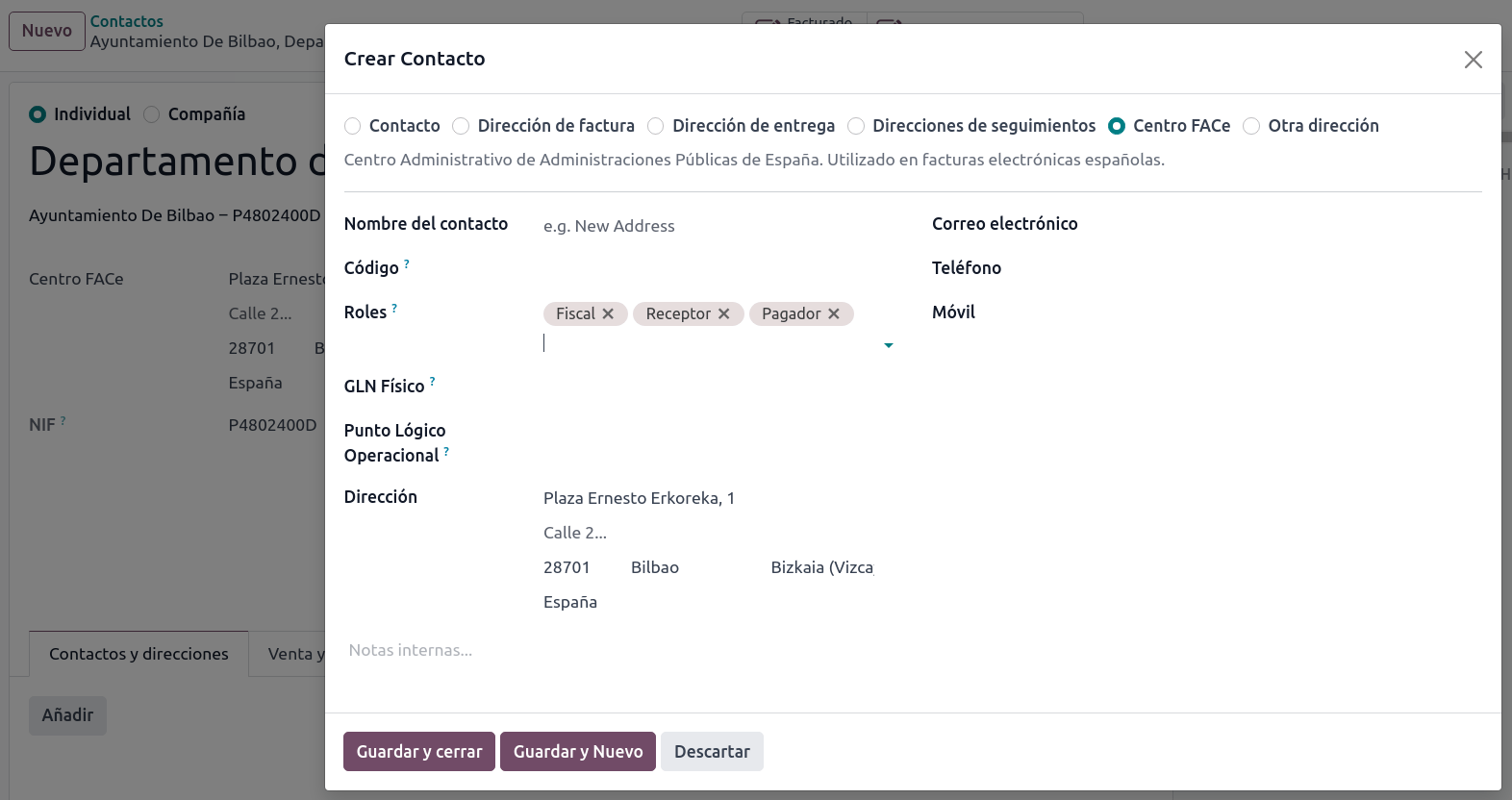

Administrative centers¶

In order for FACe to work with administrative centers, the invoice must include specific data about the centers.

Note

Make sure to have the Spain - Facturae EDI - Administrative Centers Patch (l10n_es_edi_facturae_adm_centers) module installed.

To add administrative centers, create a new contact to add to the partner company. Select FACe Center as the type, assign one or more role(s) to that contact, and Save. The three roles usually required are:

Órgano gestor: Receptor (Receiver);

Unidad tramitadora: Pagador (Payer);

Oficina contable: Fiscal (Fiscal).

Tip

If administrative centers need different Codes per role, you must create different centers for each role.

When an electronic invoice is created using a partner with administrative centers, all administrative centers are included in the invoice.

You can add one contact with multiple roles or multiple contacts with a different role each.